Over the decades, technology has transformed business operations. Advancement in technology anchors the development of industries and various sectors, resulting in making life easier and more convenient. Many industries have become beneficiaries of technological transmission, and FinTech is one of them. With the expected reach to a valuation of $1.3 trillion by 2025, growing at a CAGR of 31%, the sector using technological progress and innovations to provide better customer experience. With innovations reaching the demographics, Tier 2 and Tier 3 and Tier 4 cities can also avail the benefits of these innovations, and they are given the option to choose their preferred mode of money transfer.

Different types of Money Transfers in India with Optimum

Security Measures.

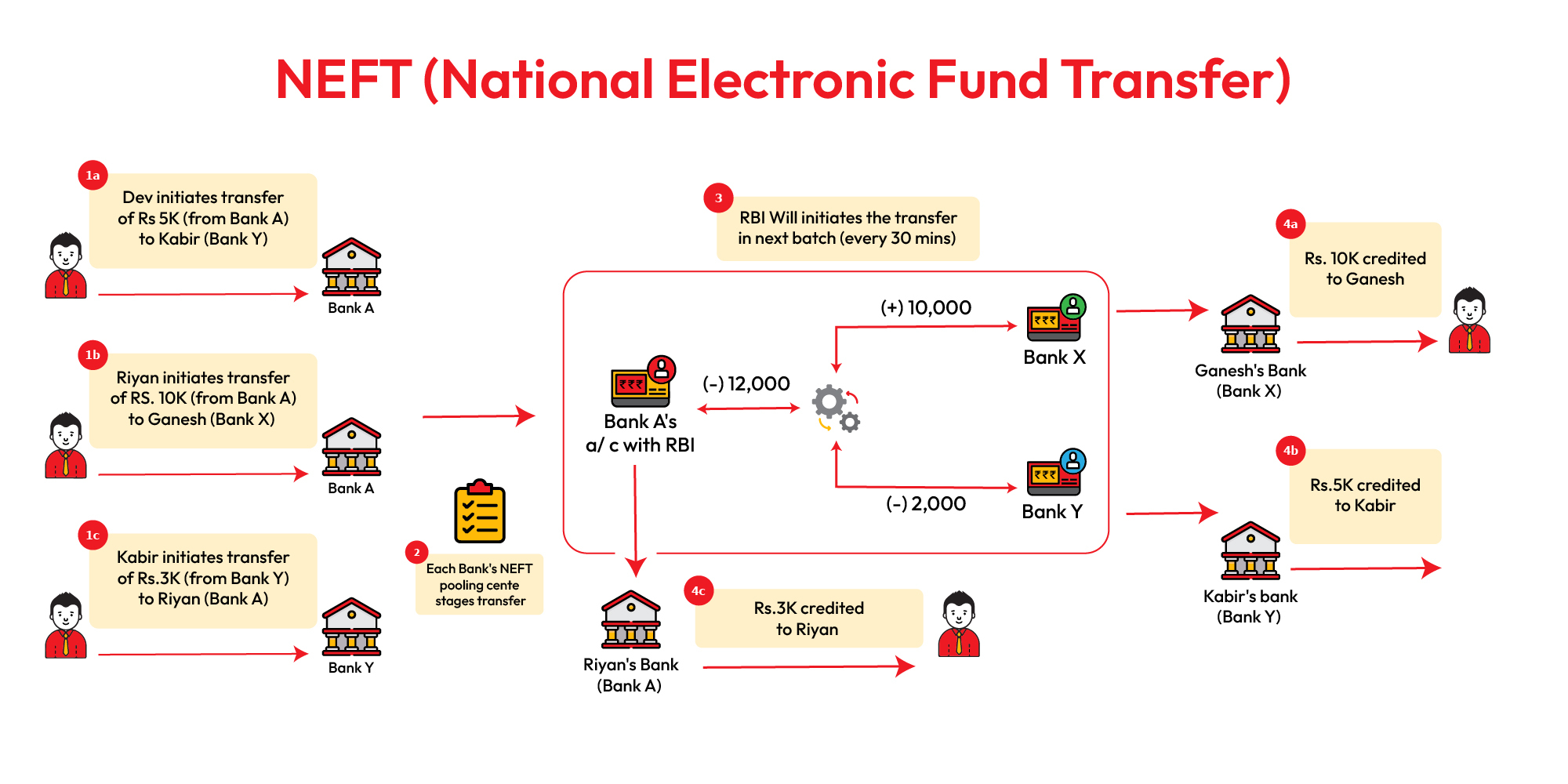

NEFT

National Electronic Funds Transfer (NEFT) is a system used to transfer funds electronically from one bank to another bank in India. NEFT is a retail electronic funds transfer system, which is used for small value transactions (typically less than Rs. 2,00,000 or equivalent in other currency) unlike Real Time Gross Settlement (RTGS) system which is used for large value transactions. NEFT transactions are usually settled within a few hours, but there may be some delay depending on various factors such as the time of day the transaction was initiated and the availability of funds in the customer's account. The transactions are settled by the Reserve Bank of India (RBI) at specific intervals throughout the day.

NEFT Process Flow

RTGS

Real-time Gross Settlement (RTGS) is a system used to transfer funds electronically from one bank to another on a real-time and gross basis. This means that the transfer of funds takes place instantly, with each transaction settled individually, rather than in batches. The "real-time" aspect of the system means that the transfer of funds occurs in real-time, as soon as the transaction is initiated, rather than being delayed until the end of the day or some other predetermined time. RTGS is typically used for high-value transactions, such as the transfer of large sums of money between banks, financial institutions, and central banks. RTGS considered to be the best method of transferring funds, as each transaction is settled individually, reducing the risk of loss due to fraud or other issues. In India, the minimum transaction limit for RTGS is 2 Lakhs and there is no maximum limit for RTGS transactions.

RTGS Process Flow

IMPS

IMPS stands for Immediate Payment Service. It is a real-time inter-bank electronic fund transfer service provided by the National Payments Corporation of India (NPCI). The service allows customers to initiate the transfer of funds using their mobile number and a unique Mobile Money Identifier (MMID) or by using the recipient's bank account number and Indian Financial System Code (IFSC). The transactions are done 24x7, including holidays. IMPS enables both personal and merchant transactions, with the added security of a one-time password (OTP) or a Mobile Personal Identification Number (MPIN) to authorise the transaction. This mode of fund transaction helps users to easily transfer money in India, from one bank account to another very conveniently through a secured procedure.

UPI

Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It allows instant money transfers between two bank accounts on a mobile platform, without the need for any physical documentation. UPI uses Virtual Payment Address (VPA) which acts as a unique identifier and allows customers to make transactions without having to share their personal details. UPI is considered one of the most convenient and secure ways for P2P fund transfers in India. People have been shifting from traditional payment methods to the digital version, and there are many reasons to adopt digital payment. The objective of Pay10’s UPI is to offer a robust platform with a set of standard APIs to facilitate an online immediate payments solution for merchants and customers.

Links-Based Money Transfers

Link Based Money transfers are a popular type of electronic fund transfer system that enables consumers to transfer money between bank accounts using a link. These links can be shared via multiple channels such as email, SMS, or messaging apps. When a consumer initiates a URL-based money transfer, the recipient’s account detail is to be entered while generating a payment link. A payment Gateway is required to generate a unique payment link which is sent to the recipient. The method of money transfer is quick and user-friendly.

Technology and finance coalesce to form a powerful, and secure system to drive the change for India to boldly forge its path towards a cashless digital economy that transcends geographical borders. Over the years the economy has witnessed drastic progress, and digital payments are gradually becoming a commodity while forming a subtle yet integral part of our lives. While customers appreciate a simple interface and advanced security systems, sellers or merchants go beyond integrating more inclusive payment solutions. Pay10 is empowering businesses with a comprehensive range of payment solutions that are aligned with the needs of end customers.